How to Lower Tax Liability Arising from Property Sale

Written by Emmanuel Sackitey Mate-Kole

Property owners are always concerned about their potential tax liability arising from the sale of a residential or commercial property and how they can lower their liability or avoid paying tax altogether. This paper will explain with practical illustrations, how an owner of land can sell property and pay little or no tax.

This is known as “tax avoidance”. Section 34 of the Income Tax Act, 2015 (Act 896) defines tax avoidance schemes to include “an arrangement, the main purpose of which is to avoid or reduce tax liability.”

Tax avoidance is possible if it is done within the ambit of the law, and it is not fictitious or misleading. An arrangement is fictitious or misleading if it does not have a substantial economic effect or its form does not reflect its substance. For instance, a person who attempts to split income with another person to reduce his tax liability is engaged in a fictitious or misleading transaction, and the Commissioner-General of the Ghana Revenue Authority (the “Commissioner-General”) may re-characterize or disregard the transaction.

There are two main taxes applicable to the sale of immovable property which can be reduced or avoided. These taxes are:

1. Capital gains tax under the Income Tax Act, 2015 (Act 896) (the “Income Tax Act”);

2. Stamp Duty under the Stamp Duty Act, 2005 (Act 689);

1. Tax on Capital Gains

Capital gains tax is a tax paid on gains made from the sale of an asset. Under the Income Tax Act, capital gains tax as we used to know it under the Internal Revenue Act, 2000 (Act 592) is abolished and gains made from the sale of assets are subsumed under sections 5 and 6 of the Act on income from business and income from investment respectively, and it is computed and taxed at 25%.

Under the Income Tax Act, capital gain rates are just as high as corporate tax rates. Therefore it is worth exploring possible strategies to keep it at a minimum or avoid it altogether.

(i) Flat rate of income tax for individuals.

The rate of tax for resident individuals who make gains from the sale of property is at a graduated rate from nil to 25% depending on the chargeable income of the resident individual and 20% for a non-resident individual. The individual who falls under a higher tax rate could choose to lower his tax liability by electing to pay a flat rate of 15% under the Income Tax Act.

The procedure to follow in lowering one’s tax liability under section 124 of the Income Tax Act is as follows:

- the individual must pick up an individual self-assessment form from the Domestic Tax Revenue Division of the Ghana Revenue Authority and give an estimate of his chargeable income for each quarter and the income tax amount to be paid on that chargeable income.

- the individual must apply the 15% tax to his chargeable income and state that as the income tax to be paid for the quarter ; and

- submit the form to the Commissioner General upon completion.

(ii) Realise an asset with a replacement asset.

The following capital gains from the realization or selling, exchanging, surrendering, distribution of a chargeable asset such as land are exempt: (a) where a person acquires an asset of the same type to replace the asset to be realised and the acquisition was done within 6 months before the date of realisation of the asset; or (b) where a person acquires an asset of the same type to replace the asset realised within 1 year after the realization of the asset. This entitles the person to full or partial exemption depending on whether the whole or part only of the amount realised is used in the acquisition of the replacement asset.

(iii) Realisation of asset by way of merger, amalgamation or re-organisation.

This arises where company A owns property and merges with company B, Company A must maintain at least 50% ownership in the property to qualify for the exemption under this rule.

The Companies Act, 1963 (Act 179) defines an amalgamation as the merger of the undertakings or a part of the undertakings of two or more companies or of the undertakings or part of the undertakings of one or more companies and one or more bodies corporate. The gains on realisation of an asset accruing to or derived by a company arising out of a merger, amalgamation or re-organisation of a company is exempt from tax where there is continuity of at least 50% of the underlying ownership in the asset. Therefore if you want to keep your tax liability low, ensure that 50% of the ownership is maintained after a merger.

(iv) Transfer asset to spouse or former spouse.

This arises where, Nii buys a house at GHs500,000 and subsequently transfers the house at an appreciated value of GHs700,000 to his wife as part of a divorce settlement or separation agreement. Although a gain of GHs200,000 is derived from the transfer, it is assumed that the property has been transferred at GHs500,000 and no gain was made, the transfer is thereby exempt from capital gains tax.

The rule is that where on the death or as part of a divorce settlement or bona fide separation agreement, an individual transfers an asset to a spouse or former spouse, that transfer is exempt from capital gains tax. Therefore you can reduce your tax liability by transferring your asset to your spouse or former spouse.

(v) Transfer of asset on death.

This arises where for example Adjorkor transfers ownership of her property to her son Adjetey in her will. Upon Adjorkor’s death, Adjetey is now the owner of the property and is exempt from paying capital gains tax.

The rule is that where an individual realises an asset on death by transferring it to another person in his will, that inheritance is exempt from capital gains tax.

(vi) Exchange rather than sell.

Exchanging real property by entering into a land exchange agreement, is a way of deferring the payment of capital gains taxes until you finally sell the asset.

For example, Kojo and Kwamena each own property. They mutually agree to exchange their properties by entering into a Land Exchange Agreement. This is a means of exchanging property without an exchange of money. The exchange will render both exempt for capital gains tax until they sell their assets.

(vii) Contributions or donations to a worthwhile cause.

This arises where for instance Mr. A regularly donates money to a local charity. He decides to sell his property. The property was bought for GHs500,000 and is now worth GHs700,000 meaning he has accrued a gain of GHs200,000. However, as Mr. A has contributed to a charitable organization within the past year, the amount of money he has donated can be deducted from the amount of capital gains tax he has to pay.

The rule is that if you donate or contribute to a worthwhile cause, you may claim a deduction that is equal to the contribution or donation made during that year. The following are worthwhile causes: charitable organisations; a scheme of scholarship for an academic, technical, professional or other course of study; development of any rural area or urban area; sports development or sports promotion; and any other worthwhile cause approved by the Commissioner-General.

2. Stamp Duty

Stamp duty is a tax placed on an instrument transferring land.

Section 14 of the Stamp Duty Act, 2005 (Act 689) provides that an instrument affecting land should not be registered unless the instrument is stamped. The stamp duty is payable by the purchaser unless otherwise agreed. The duty must be paid within two months of executing the conveyance.

The stamp duty exposure for conveyances where the amount of the value of consideration is not more than GHs10,000 is 0.25% of the purchase price; and for conveyances where the amount of the value of the consideration is more than GHs10,000 but less than GHs50,000 is 0.5% of the purchase price; and for conveyances where the amount of the value of consideration is more than GHs50,000 is 1% of the purchase price.

The following transactions are not subject to stamp duty. This means that the purchaser can avoid stamp duty if he can arrange the transfer in such a way that he can benefit from the exemptions outlined below.

a) Transfers made as part of a divorce settlement;

b) Transfers made upon gifts intervivos from one spouse to another or from a parent to a child or from a child to a parent;

c) Transfers or conveyance to charities;

d) An agreement, conveyance or other instrument relating to property of a company during winding-up;

e) Transfer of property under will or other instruments relating to testamentary dispositions.

f) Probates, letters of administration and vesting assents.

g) All instruments on which the duty would be payable by the Government. A party can benefit from this provision if it places the stamp duty obligation on the Government.

h) A conveyance transferring land from the State Housing Company Limited or Tema Development Company Limited to a person.

i) A mortgage of land where the mortgagee is the State Housing Company Limited or Tema Development Company Limited.

j) A conveyance transferring land from a person engaged in the business of construction of residential accommodation for sale or letting to any other person if the vendor has registered that business with the Commissioner-General.

All the above exemptions will apply if the buyer or beneficiary of the transfer can prove to the Land Valuation Division of the Lands Commission that he qualifies for the exemption.

Please note that a document exempt from stamp duty shall not be considered as stamped unless it is stamped with a particular stamp indicating that it is not chargeable with any duty.

These are some of the ways in which property owners can reduce or avoid paying taxes that may arise from the sale of property.

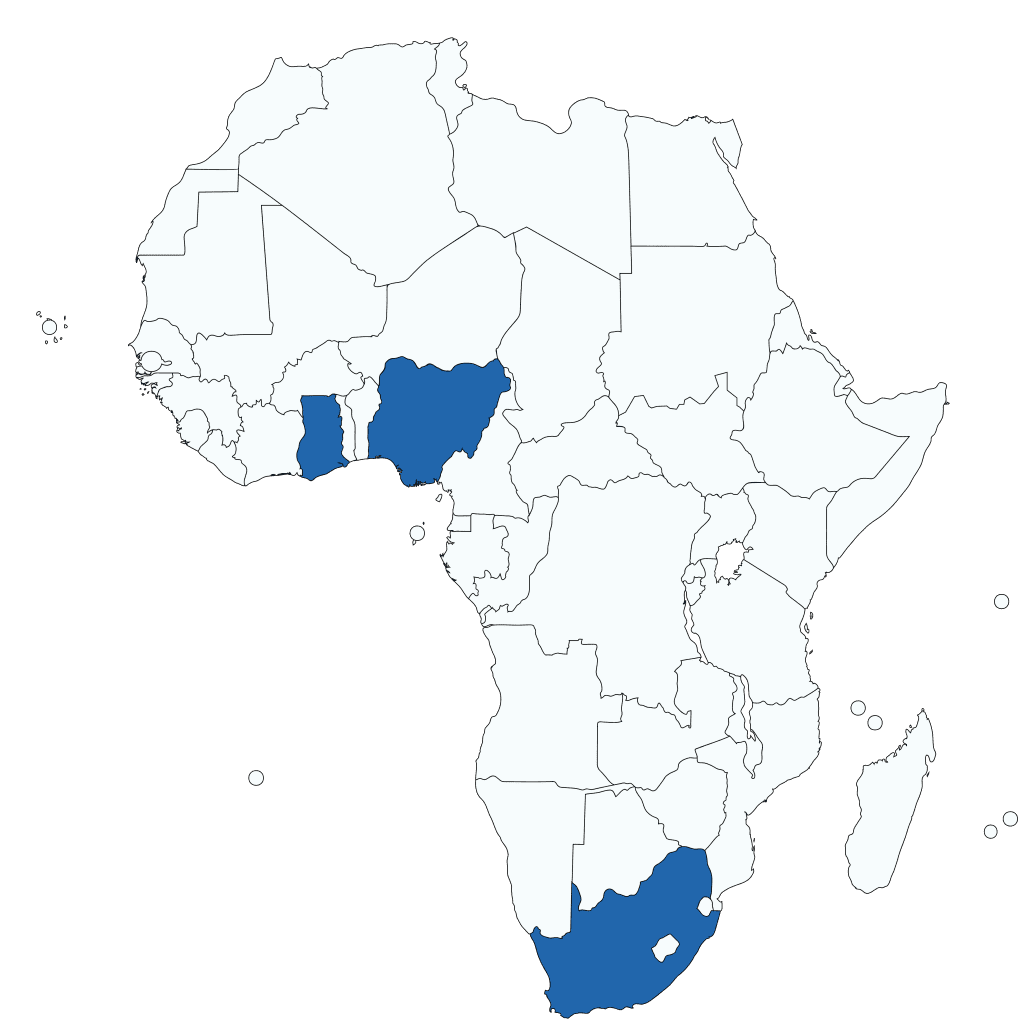

Our Locations

If you are a developer, buyer or work within the Real Estate industry, we want to hear from you.

Nigeria Office

(+234) 903 699 9862

Ghana Office

+233 50 134 7447

South Africa Office

(+27) 83 394 0097

UK Office

(+44) 7867 786989